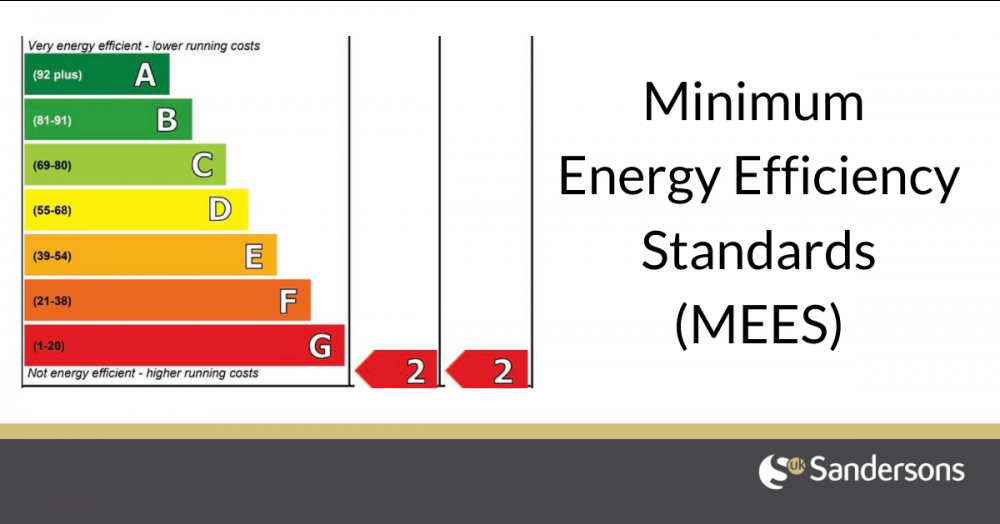

Minimum Energy Efficiency Standards (MEES) in private rented property

The Domestic Minimum Energy Efficiency Standard (MEES) Regulations set a minimum energy efficiency level of E for domestic private rented properties. Properties with F or G ratings will require improvement works to be carried out to meet the minimum E rating (unless it qualifies for an exemption or exceeds the cost cap detailed below).

The Regulations apply to all domestic private rented properties that are:

- let on an Assured, Assured Shorthold, Regulated or domestic agricultural tenancy agreement

- legally required to have an Energy Performance Certificate (EPC). If the property you let has been marketed for sale or let, or modified, in the past 10 years then it will probably be legally required to have an EPC.

Please click here to find out the requirements for an EPC and if your property may qualify for an exemption

When you need to take action to improve your property to EPC E

If you are letting or planning to let a property covered by the MEES Regulations, and with a rating of EPC F or G, there are 2 dates:

- 1 April 2018

- 1 April 2020

Working out when you need to take action

- Tenancy started before 1 April 2018 and runs until at least 1 April 2020: You have until 1 April 2020 to improve the property rating to E, or register an exemption, if you want to continue to let it

- Tenancy started before 1 April 2018, but you plan to enter a new tenancy (with a new or existing tenant) before 1 April 2020, you need to improve the property rating to E, or register an exemption, before you enter into the new tenancy or renew an existing tenancy

- Tenancy started on or after 1 April 2018- If you haven’t already taken action, you must improve the property’s rating to E immediately, or register an exemption

If your property is currently empty, and you are not planning to let it, you don’t need to take any action to improve its rating until you decide to let it again.

Funding improvements to your property

The cost cap: you will never be required to spend more than £3,500 (including VAT) on energy efficiency improvements.

If you cannot improve your property to EPC E for £3,500 or less, you should make all the improvements which can be made up to that amount, then register an ‘all improvements made’ exemption.

There are 3 ways to fund the improvements to your property:

Option 1: Third party funding

If you are able to secure third-party funding to cover the full cost of improving your property to EPC E, you can use this and you don’t need to invest your own funding:

- the cost cap does not apply

you should make use of all the funding you secure to get your property to band E, or if possible higher. Funding can include:

- Energy Company Obligation (ECO)

- local authority grants

- Green Deal finance

Option 2: Combination of third-party funding and self-funding

If you can secure third-party funding but it is:

- less than £3,500, and

- not enough to improve your property to EPC E you may need to top up with your own funds to the value of the cost cap.

Please note

- you can count any energy efficiency investment made to your property since 1 October 2017 within the cost cap

- if your property can be improved to E for less than the cost cap, that is all you need to spend

Option 3: Self funding

If you are unable to secure any funding, you need to use your own funds to improve your property. You will never need to spend more than the cost cap.

You do not need to spend up to £3,500 if your property can be improved to EPC E for less. If you can improve your property to E for less than the cap, you will have met your obligation.

If it would cost more than £3,500 to improve your property to E, you should install all recommended measures that can be installed within that amount, then register an exemption.

If you have made any energy efficiency improvements to your property since 1 October 2017, you can include the cost of those improvements within the £3,500 cost cap

Selecting energy efficiency measures

Your EPC report will include a list of recommendations detailing measures which should improve the energy efficiency of your property. It will include both a short list of top actions you can take, and a more detailed list further down setting out all recommended measures. The recommendations will help you choose which measure or combination of measures to install.

The MEES Regulations refer to the concept of ‘relevant energy efficiency improvements’. This is a measure, or package of measures, recommended in your EPC report, which can be purchased and installed for £3,500 or less (including VAT) - the cost cap.

If you have installed all ‘relevant energy efficiency improvements’ for your property, but your property’s EPC rating is still below E, you can register an exemption on the grounds that ‘all relevant improvements have been made and the property remains below an E’. This exemption lasts 5 years. After that it will expire and you must try again to improve the property’s EPC rating to E. If it is still not possible, you may register a further exemption.

You are free to install any energy efficiency measure(s), but:

- if your chosen improvements do not appear in the list of ‘recommended energy efficiency improvements’

- and they fail to improve your property to EPC E

You will not be able to let the property or register an ‘all relevant improvements made’ exemption. You will then need to make further attempts to improve the rating to a minimum of E, in order to let the property.

Temporary exemption due to recently becoming a landlord:

If you have recently become a landlord under certain circumstances (see section 4.1.6 in Chapter 4 of the full Guidance document for details of those circumstances) you will not be expected to take immediate action to improve your property to EPC E. You may claim a 6 months exemption from the date you became a landlord.

This exemption lasts 6 months from the date you became the landlord. After that it will expire and you must have either:

- improved the property to EPC E

- or registered another valid exemption, if one applies

To register this exemption, you need to provide this additional information:

- the date on which you became the landlord for the property

- the circumstances under which you became the landlord

Register an exemption

- Register an exemption and create an account

- enter the address of your property

- state the type of exemption you want to register

- upload all the required evidence, including a copy of a valid EPC for the property (the Register can accept pdf, png, jpg, jpeg, doc or docx files, with a maximum size of 4 MB per file)

Exemption data cannot be amended once the data has been submitted. Make sure you have checked everything carefully before submitting.

All exemptions apply from the point you register them.

If you improve an exempt property to E after having registered an exemption (or stop renting the property out) you can cancel the exemption by going to your account ‘dashboard’ page and selecting ‘View or manage my exemptions’.

Members of the public can:

- search the Exemptions Register for details of exempt properties

- search the Exemptions Register for details of penalty notices issued by enforcement authorities

Enforcement and penalties

The MEES Regulations are enforced by local authorities, who have a range of powers to check and ensure compliance.

The Regulations mean that, since 1 April 2018, private landlords may not let domestic properties on new tenancies to new or existing tenants if the Energy Efficiency Certificate (EPC) rating is F or G (unless an exemption applies).

From 1 April 2020 the prohibition on letting F and G properties will extend to all relevant properties, even where there has been no change in tenancy.

If a local authority believes a landlord has failed to fulfil their obligations under the MEES Regulations, they can serve the landlord with a compliance notice. If a breach is confirmed, the landlord may receive a financial penalty.

Non-compliance with the Regulations

Your local authority may check for different forms of non-compliance, including one or more of the following:

- from 1 April 2018, you let your property in breach of the Regulations

- from 1 April 2020, you continue to let your property in breach of the Regulations

- you have registered any false or misleading information on the PRS Exemptions Register

Compliance notices

If a local authority believes a landlord may be in breach, they may serve a compliance notice requesting information to help them decide whether a breach has occurred. They may serve a compliance notice up to 12 months after a suspected breach occurred.

A compliance notice may request information on:

- the EPC that was valid for the time when the property was let

- the tenancy agreement used for letting the property

- information on energy efficiency improvements made

- any Energy Advice Report in relation to the property

- any other relevant document

Penalties

If a local authority confirms that a property is (or has been) let in breach of the Regulations, they may serve a financial penalty up to 18 months after the breach and/or publish details of the breach for at least 12 months. Local authorities can decide on the level of the penalty, up to maximum limits set by the Regulations.

The maximum penalties amounts apply per property and per breach of the Regulations. They are:

- up to £2,000 and/or publication penalty for renting out a non-compliant property for less than 3 months

- up to £4,000 and/or publication penalty for renting out a non-compliant property for 3 months or more

- up to £1,000 and/or publication for providing false or misleading information on the PRS Exemptions Register

- up to £2,000 and/or publication for failure to comply with a compliance notice

The maximum amount you can be fined per property is £5,000 in total.